Follow EconomicaNatura On Facebook and Twitter

By Mark Lundegren

Are you more of an economist than an ecologist, or the reverse?

In truth, the two disciplines have many common features, and economists and ecologists alike can learn a great deal from one another. And though this proposal may be uncommon, it really shouldn’t be a surprise.

After all, each field involves the study of resources. This includes their creation or acquisition, their transmission and synthesis, their obsolescence, and their combined and often evolving effects. Owing to this, we well might think of human economics as material ecology, and ecology as natural economics.

Ecology And Economics Clearly Converge In Human Food Systems, But This Is Only A Beginning

To make this point clearer, and perhaps more actionable and aiding to your efforts, I would like to spend a few minutes showing how several core principles of ecology apply or correspond to those of economics. This is both at a holistic or macroeconomic level and at the level of organizations and entrepreneurs, or microeconomically. And though I won’t pursue a reverse analysis here, I would encourage this and believe you will find that many central ideas in economics find an analogous, instructive, and aiding place in the field of ecology as well.

As you may know, ecology is a scientific field within biology that studies the interactions of organisms with one another and their larger environment. This includes effects between species, ones on and by overall ecosystems, and ones owing to both living and non-living factors. Much as with economics, or the study of human material production, ecology frequently concerns itself with organization and structure, diversity and innovation, population dynamics and migration, cooperation and competition, interaction and behavior more generally, and maturation and obsolescence. Like economics, ecology also often pays special attention to – and may seek to aid or restore – resource production and cycling, niche construction, and the movement of energy (or value) through systems and subsystems (on all these points, see Wikipedia Ecology).

I will leave you to consider these introductory ideas, but trust they make a strong case there are important similarities between the two disciplines – and ones, I would add, that are often overlooked and thus a waiting source of new or improved insights in both directions. For the remainder of our discussion, I will show how specific ideas from ecology find not only an analogous place in economics, but also in ways that might benefit the modern entrepreneur and economic enterprise.

Here are 15 topics from the field of ecology with important lessons – some propelling, others more cautionary – for modern economics and innovation (to explore these topics, again see Wikipedia Ecology):

1. Hierarchy – this is the idea that all of nature is structure, or rather a series of structures at different scales, and thus a hierarchical or nested framework of natural activities and processes. Nature’s hierarchical structure ranges from those at the level of genes and organisms all the way to large ecosystems and whole biospheres. A crucial takeaway for modern economics is that this idea not only applies to human productive systems, but that people and organizations are wise to have an adequate model of how immediate and larger market systems are structured and function, including locating our current and potential place within them.

2. Biodiversity – diversity is a common and normally health-increasing or resilience-aiding feature of life and ecological systems, and once again at many levels. This seems an essential lesson for both organizations and larger economies, highlighting natural perils in narrow or inflexible products and sources of value, supply and distribution chains, culture and thinking, and operations or processes, all to begin a list.

3. Habitat – related to hierarchy, habitat is the specific setting or settings in which organisms and species live, with important parallels to the idea of customer segments or markets in economics. In both cases, crucial points of consideration are the setting’s breadth or size, vibrancy or rate of change, relative openness to new entrants, and likely stability or risk of collapse in time. As such, all firms and innovators should be clear on the size and dynamics of their current and most likely future markets, or economic habitats.

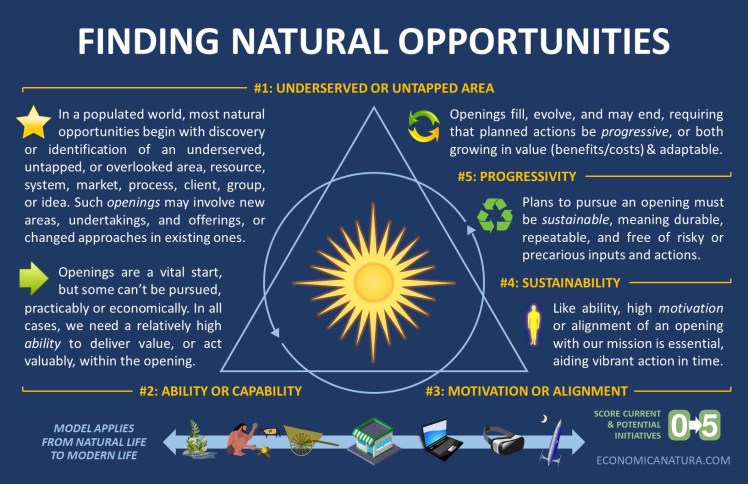

4. Niche – this is the specific place and manner in which species function in their habitats, which usefully can be thought of as operating either as focused specialists or more ranging (and often longer-lived, but more effortful) generalists, with determinations always begging questions of the scale or level of analysis. Again, organizations and entrepreneurs are wise to be clear on their locational and functional niche(s), and the natural opportunities and limitations each naturally affords.

5. Niche construction – crucially, organisms and species do not only dwell in niches within larger habitats, they actively create and construct their niches, and also evolve them over time and with the demands of adaptive change. The essential lesson for people and organizations is the need to proactively construct and continually improve their niches, and especially not to accept existing habitat or market conditions and niches or operational practices as given, inviolable, or unimprovable.

6. Biomes & Biospheres – these terms refer to ecosystems at the regional and planetary levels. Key lessons for entrepreneurs and their organizations are that while species and organisms may be primarily concerned and affected by their immediate habitats and niches, they are never fully isolated from larger forces and processes. Notably, this includes both threats of extinction and opportunities for expansion or transformation, each waiting beyond well-known horizons.

7. Population ecology – population dynamics are a complex topic, but an important takeaway from its study is that habitats and niches almost inevitably will become filled relative to available resources. For naturally health-seeking enterprises and innovators, there are at least two important lessons. One is that high growth conditions can be expected to eventually reach saturation or commoditization, and thus growing demands for either new efficiency or novelty. The other is that, amid saturation, a third option is possible – the identification and construction of new and more open niches. Often, as in natural life, these will be adjacent to existing operations, whether in terms of client type, organizational capabilities, or both.

8. Metapopulations & migration – these concepts are used describe the ecological phenomenon of species re-populating diminished or untenable and thus formerly abandoned or avoided local habitats and niches, as conditions improve or constraints are removed. An essential lesson for economic life here is that products, clients, segments, or regions may be in disfavor or unserviceable today, but this is subject to change. As such, firms are wise not to burn bridges as they exit, avoid, or are unable to access product lines, segments, and relationships.

9. Community ecology – a term delineating the interaction of different species and their niches within a habitat or local area. While co-located species sometime operate in parallel and without appreciable interaction, scientists routinely find value-adding interactions, in fact or waiting, between many species, even quite dissimilar ones. The economic analog of this is the importance of local networking, community involvement and pursuit of easy synergies, and expectations of untapped value around any person or organization.

10. Ecosystem ecology – this is community ecology on a wider or larger scale. While there may be similarities to community ecology in basic process, often the opportunities for more systemwide networking and synergy are different. For example, extra-local networking may be more difficult, resource-intensive, time-consuming, or otherwise demanding, and require both greater capacity and effort overall. However, and again as with natural life, these efforts also may hold far more significant and transformative opportunities too.

11. Food webs or chains – these are models that describe the lesser and greater movement of resources – from sunlight to derived foods – through organisms, niches, habitats, ecosystems, biomes, and overall biospheres. The corresponding concept in economics is that of value chains, which describe either the firm-level or aggregated movements of raw materials into final finished products. In natural life and modern economics, awareness of our current and potential food webs or value chains of course can be enormously beneficial, especially if we and our groups are either survival or growth-oriented.

12. Trophic levels – the various layers or strata in food webs or chains, with each ascending layer principally feeding on organisms below their level. As with population dynamics, this is another complex area of ecology, but one that offers an important lesson for individuals, organizations, and even whole economies. This is the naturally increasing material dependency and potential for volatility that accompanies higher vertical levels in the resource webs or value chains that form human economies. In each case, both species and enterprises can become distanced from essential, and often overlooked or unseen, natural resources. A core takeaway here for entrepreneurs is a full and careful understanding of essential supply chains and their inevitable risks.

13. Keystone species – these normally are the top predator species in a habitat or ecosystem, ones that naturally feed and depend on, and in turn often healthfully regulate, apportion, and organize species in lower trophic levels – and thus, as the name implies, often control, order, and stabilize habitats and ecosystems overall. Notably, removal of keystone species is often disastrous for habitats and ecosystems, and the natural diminution of keystones usually is a sign of larger stressors in an environment. In addition to awareness of economic hierarchies and value chains, a key lesson here is the importance of understanding the keystone firms in relevant industries and larger economic systems, since these naturally will influence or organize, and often constrain or define, lesser organizations and their opportunities. And as in natural systems, they will often signal the overall health of their industry or sector.

14. Holism – this important or keystone principle of ecology is the importance of appreciating the profound complexity and often vast synergy of evolved ecological systems. Whether for ecologists or entrepreneurs the lesson is the same – use simplified models of life and work at your peril. While these may be useful in the short-term, they inevitably will be incomplete and their overreliance is likely to lead to unwelcome surprise in time.

15. Sustainability – the final lesson of ecology for economics I will highlight is that of natural sustainability, or the need for evolving species and ecosystems to act and adapt in ways that can endure. Of course, some economic ventures are short-term by design and thus less constrained in this regard. But most enterprises, and certainly most modern economies, will want to ensure ecological sustainability, economic sustainability, and of course social or client sustainability too.

Whatever your area of effort and focus, I would encourage you to consider these interesting and often important ecological lessons for modern economic and entrepreneurial life, and welcome your comments and questions. In the least, the comparison can and should remind us that economic activity, or economics, always occurs in the larger context or system that is nature, and as such, is ultimately ecological activity, or ecologics.

Mark Lundegren is the founder of EconomicaNatura.

Tell others about EconomicaNatura…encourage modern natural enterprise & innovation!